Loanable Funds Market Demand Shifters

Loanable Funds Market Demand Shifters. In these capital markets, firms are typically demanders of capital loanable funds consist of household savings and/or bank loans. Loanable funds market supply and demand for loans real interest rate vs quantity of loans Reconciling the two interest rate models: The demand and supply for different types of capital take place in capital markets. Because investment in new capital goods is frequently made with loanable funds. Firms will have a choice of a range of projects ranging from the most profitable to the least profitable. The market for foreign currency exchange. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance expenditures (investment or consumption).

This video explains the intuition behind shifting the demand curve for loanable funds. What entities demand money from the loanable funds market? What happens in the loanable funds market when the government runs deficit? Stock exchanges, investment banks, mutual funds firms, and commercial banks. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. So drawing, manipulating, and analyzing the loanable funds market isn't too difficult if you remember a few key things. The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. Real interest rate slenders re dborrowers qloans quantity of loans 10. All borrowing, loans, & credit {direct}.

The part of the increase not taken from savings, will have to reduce.

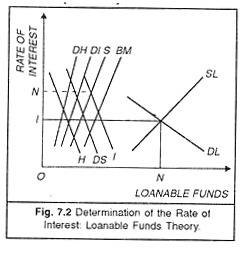

V borrowing in order to spend. Real interest rate quantity of loanable funds r* qlf* demand for loanable funds* (consumers/businesses) supply of loanable funds* (consumers/businesses/governments) market for loanable funds 11 the struggle ensues…. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. The market for loanable funds brings savers and borrowers together. · this is what is known as the loanable funds graph or the. The interest rate in the short. The demand and supply for different types of capital take place in capital markets. ¡ the market for loanable funds shows us how the financial system coordinates savings & investment. The market in which the demand for private investment and the supply of household savings intersect to determine the equilibrium real interest rate. Demand for loadable funds the demand for loadable funds comes mainly from three fields: (i) investment, (ii) consumption and (iii) hoarding.

The interest rate in the short. Stock exchanges, investment banks, mutual funds firms, and commercial banks. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. Real interest rate quantity of loanable funds r* qlf* demand for loanable funds* (consumers/businesses) supply of loanable funds* (consumers/businesses/governments) market for loanable funds 11 the struggle ensues….

The demand for loanable funds is determined by the amount that consumers and firms desire to invest.

When displayed on a graph of real interest rate vs. In this video i explain the three shifters of the money supply. Firms will have a choice of a range of projects ranging from the most profitable to the least profitable. Real interest rate quantity of loanable funds r* qlf* demand for loanable funds* (consumers/businesses) supply of loanable funds* (consumers/businesses/governments) market for loanable funds 11 the struggle ensues…. The market for loanable funds consists of two actors, those loaning the money (savings from households like us). We can also represent the same idea using a mathematical. Anything that increases the amount of investment that households and. Savings and investment are affected primarily by the interest rate. Loanable funds are also demanded for hoarding purposes that is for the satisfaction of the desire of people to hold money. The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. The demand for loanable funds is determined by the amount that consumers and firms desire to invest. When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. The demand for loanable funds is limited by the marginal efficiency of capital, also known as the marginal efficiency of investment, which is the rate of return that could be earned with additional capital. ¡ the market for loanable funds shows us how the financial system coordinates savings & investment. The market in which the demand for private investment and the supply of household savings intersect to determine the equilibrium real interest rate.

For the market of loanable funds, the supply curve is determined by the aggregate level of savings within the economy. Firms will have a choice of a range of projects ranging from the most profitable to the least profitable. International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for.

• the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities.

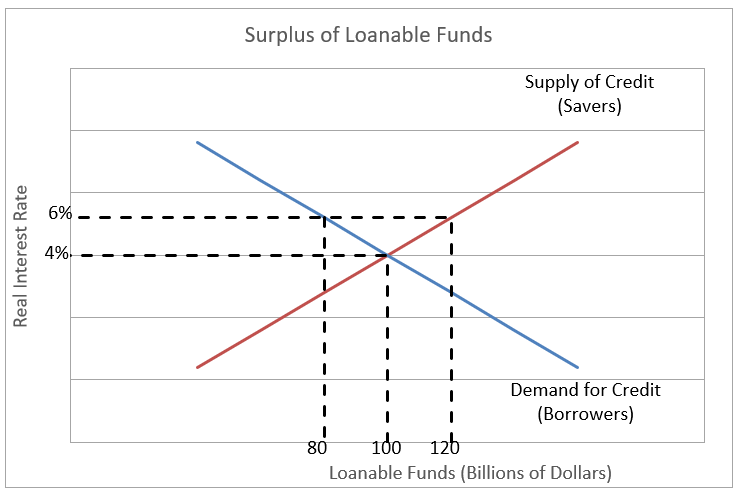

— the demand curve represents the demand for credit by borrowers and the supply curve represents the supply of credit. The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity. Quantity of money, we see that we have a basic supply and demand graph. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance expenditures (investment or consumption). According to this approach, the interest rate is determined by the demand for and supply of loanable funds. ¡ the market for loanable funds shows us how the financial system coordinates savings & investment. The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan. In economics, the loanable funds doctrine is a theory of the market interest rate. What entities demand money from the loanable funds market? Quizlet is the easiest way to study, practise and master what. Loanable funds market demand shifters supply shifters • confident businesses. How do savers and borrowers find each other? • the loanable funds market includes:

· this is what is known as the loanable funds graph or the loanable funds market shifters. In the previous section we learned that a firm's decision to acquire and keep capital depends on the net present value of the.

Source: myincandescentmind.files.wordpress.com

Source: myincandescentmind.files.wordpress.com The loanable funds market graph background.

Source: slideplayer.com

Source: slideplayer.com With demand for capital constant, interest rates will rise.

International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for.

Source: slidetodoc.com

Source: slidetodoc.com Shifting the demand curve for loanable funds.

Source: www.higherrockeducation.org

Source: www.higherrockeducation.org So drawing, manipulating, and analyzing the loanable funds market isn't too difficult if you remember a few key things.

We can also represent the same idea using a mathematical.

Source: slideplayer.com

Source: slideplayer.com When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways.

Source: welkerswikinomics.com

Source: welkerswikinomics.com The demand for loanable funds is limited by the marginal efficiency of capital, also known as the marginal efficiency of investment, which is the rate of return that could be earned with additional capital.

Source: www.cliffsnotes.com

Source: www.cliffsnotes.com Loanable funds market at the equilibrium real interest rate the amount borrowers want to borrow equals the amount lenders want to lend.

Source: s3.studylib.net

Source: s3.studylib.net In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real interest rates.

Source: welkerswikinomics.com

Source: welkerswikinomics.com Real interest rate quantity of loanable funds r* qlf* demand for loanable funds* (consumers/businesses) supply of loanable funds* (consumers/businesses/governments) market for loanable funds 11 the struggle ensues….

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com In the previous section we learned that a firm's decision to acquire and keep capital depends on the net present value of the.

Source: www.reviewecon.com

Source: www.reviewecon.com Stock exchanges, investment banks, mutual funds firms, and commercial banks.

Source: images.slideplayer.com

Source: images.slideplayer.com The market for loanable funds.

Source: slideplayer.com

Source: slideplayer.com ¡ the market for loanable funds shows us how the financial system coordinates savings & investment.

Source: slideplayer.com

Source: slideplayer.com With demand for capital constant, interest rates will rise.

Source: 14yagnvi.files.wordpress.com

Source: 14yagnvi.files.wordpress.com Loanable funds are also demanded for hoarding purposes that is for the satisfaction of the desire of people to hold money.

Source: s3.studylib.net

Source: s3.studylib.net Stock exchanges, investment banks, mutual funds firms, and commercial banks.

Source: media.cheggcdn.com

Source: media.cheggcdn.com Loanable funds market demand shifters supply shifters • confident businesses.

Source: i.stack.imgur.com

Source: i.stack.imgur.com Savings and investment are affected primarily by the interest rate.

Savings and investment are affected primarily by the interest rate.

Demand for loanable funds• the demand curve for loanable funds slopes downward, because the decision for a business to borrow money to finance a project depends on the interest rate the business faces and the rate of return on its project (which is the profit earned on the project.

Source: openoregon.pressbooks.pub

Source: openoregon.pressbooks.pub In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real interest rates.

Source: www.reviewecon.com

Source: www.reviewecon.com Savings and investment are affected primarily by the interest rate.

Source: myincandescentmind.files.wordpress.com

Source: myincandescentmind.files.wordpress.com In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: pressbooks.com

Source: pressbooks.com For the market of loanable funds, the supply curve is determined by the aggregate level of savings within the economy.

Source: i1.wp.com

Source: i1.wp.com Anything that increases the amount of investment that households and.

Source: slideplayer.com

Source: slideplayer.com Reconciling the two interest rate models:

Posting Komentar untuk "Loanable Funds Market Demand Shifters"